Compound interest calculator dave ramsey

Dave Ramseys investment calculator states the SP 500 averages returns near 12. An interest calculator present value calculator property investment calculator and annuity calculator are some of the best and most valuable examples of what you can find.

Excel Future Value Compound Interest Formula White Coat Investor

A P 1 rn nt where P is.

. Troy MI 48084-4162. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Enter a percentage interest rate - either yearly monthly weekly or daily.

When estimating growth play it conservative. The power of compound interest is absolutely incredible and one of the easiest ways to see it in action is by projecting your investments with a calculator like the. Heres a little secret.

Compound growth also called compound interest is a millionaires best friend. For example a 1000 investment. The formula for compound apr is.

Enter a number of years or months or a combination of both for the calculation. Heres the story behind the chart. But rememberan investment calculator doesnt.

Personally thats a bit high. Its the money your. 201 W Big Beaver Rd Suite 715.

A P 1 rn nt where P is the. An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now. Dave Ramsey and the.

How to Grow Your. Sometimes it takes real-life application for a concept to click. Enter an initial balance figure.

Dave Ramseys investment calculator is a compound interest calculator freely available on his website. The compound interest rate or interest on account is calculated using the compound benefit formula. Dave Ramsey Rachel Cruze Ken Coleman Dr.

Compound Daily Interest Calculator. We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. A convenient way to track your potential compound interest.

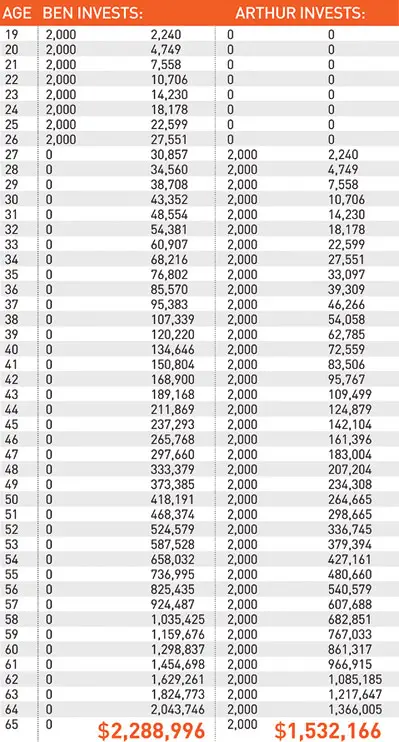

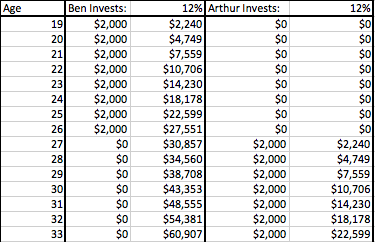

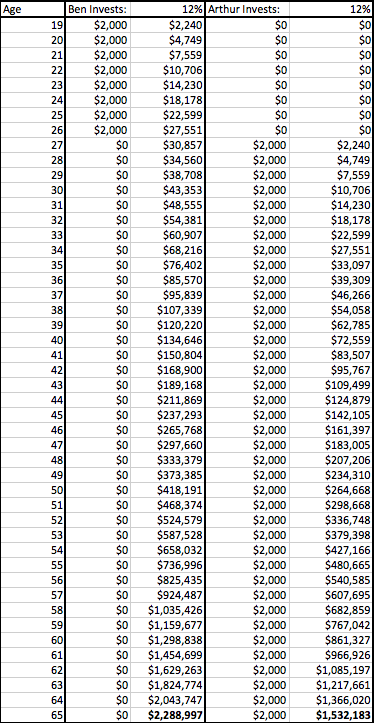

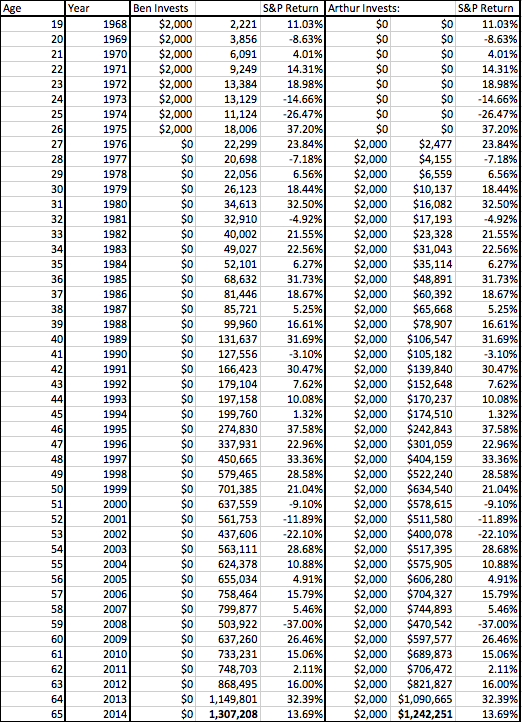

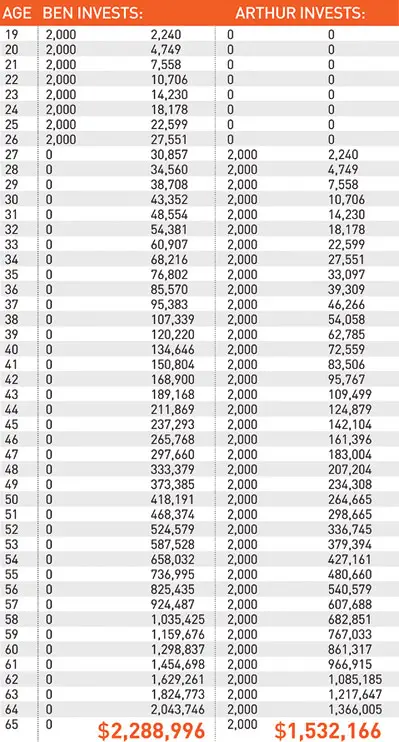

Dave Ramseys investment calculator is a compound interest calculator freely available on his website. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. Ben and Arthur are close friends.

Try using our compound interest calculator that will do the calculations for you. Ben starts investing at the age of 19. But by depositing an additional 100 each.

A Millionaires Best Friend. I tested it from the point of a student working on a project. The compound interest rate or interest on account is calculated using the compound benefit formula.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. For 8 years he invests 2000 annually in investments that earn him 12 in compound.

If You Want To Get Rich Compounding Start Young How To Get Rich Dave Ramsey Baby Steps Interest Calculator

Teen Millionaire The Problem With Dave Ramsey S Teen Millionaire

Excel Future Value Compound Interest Formula White Coat Investor

Compounding Interest Rate Chart Interest Rate Chart Financial Charts Chart

Teen Millionaire The Problem With Dave Ramsey S Teen Millionaire

Calculators Dr Breathe Easy Finance Budgeting Finances Budgeting Finance

Pin On Finance Fun

Our Compound Interest Calculator Not Only Highlights The Value Of Personal Savings It Also Illustrates Interest Calculator Compound Interest Personal Savings

5 Fun Ways To Teach Compound Interest Ramseysolutions Com

Daily Interest Calculator Simple Or Compounding Between Dates Interest Calculator Loan Best Payday Loans

Teen Millionaire The Problem With Dave Ramsey S Teen Millionaire

Ramsey Investment Calculator Deals 58 Off Www Ingeniovirtual Com

Compound Interest Calculator Arrest Your Debt

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

The Surprisingly Simple Math To Retiring On Real Estate Retirement Calculator Savings Calculator Retirement Savings Calculator

Excel Future Value Compound Interest Formula White Coat Investor

Entering The Workforce Tips For A Secure Financial Future